Business Insurance in and around Ardmore

Get your Ardmore business covered, right here!

Helping insure small businesses since 1935

Your Search For Great Small Business Insurance Ends Now.

When you're a business owner, there's so much to take into account. It's understandable. State Farm agent Amber Knight is a business owner, too. Let Amber Knight help you make sure that your business is properly protected. You won't regret it!

Get your Ardmore business covered, right here!

Helping insure small businesses since 1935

Protect Your Business With State Farm

State Farm has provided insurance to small business owners for almost 100 years. Business owners like you have counted on State Farm for coverage from countless industries. It doesn't matter if you are a real estate agent or an optician or you own a pet store or a toy store. Whatever your business, State Farm might help cover it with personalized policies that meet each owner's specific needs. It all starts with State Farm agent Amber Knight. Amber Knight is the person who can relate to where you are firsthand because all State Farm agents are business owners themselves. Contact a State Farm agent to familiarize yourself about your small business insurance options

It's time to call or email State Farm agent Amber Knight. You'll quickly discover why State Farm is the reliable name for small business insurance.

Simple Insights®

Tips for tenant screening

Tips for tenant screening

Screening tenants is your key to success. Find out how to check tenant credit reports and perform a background check.

Importance of a business continuation plan

Importance of a business continuation plan

Find out why it's important to have a business succession plan in place before the time of death to benefit the surviving owners and heirs.

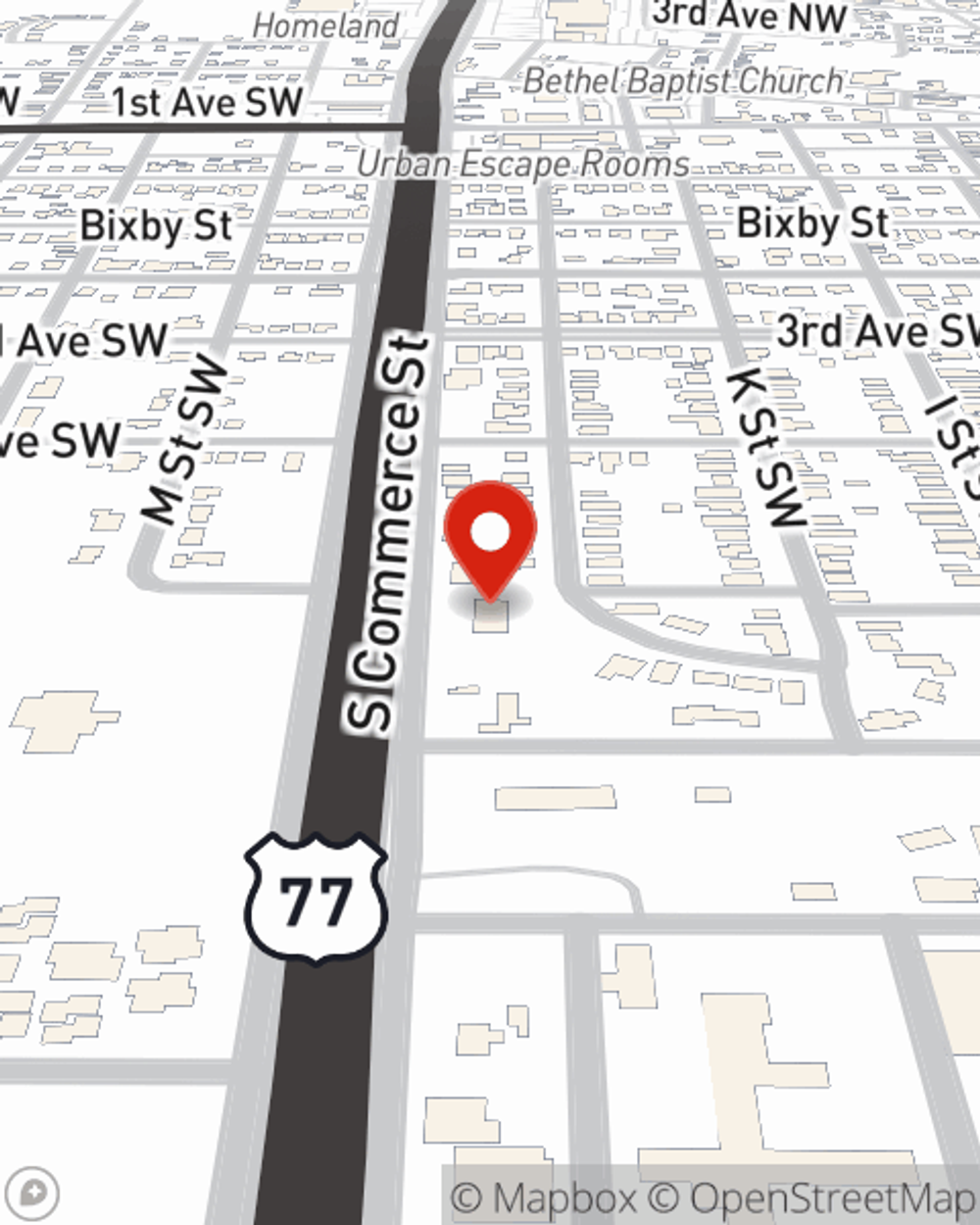

Amber Knight

State Farm® Insurance AgentSimple Insights®

Tips for tenant screening

Tips for tenant screening

Screening tenants is your key to success. Find out how to check tenant credit reports and perform a background check.

Importance of a business continuation plan

Importance of a business continuation plan

Find out why it's important to have a business succession plan in place before the time of death to benefit the surviving owners and heirs.